- Blog

Amazon’s Exit from Google Ads: What Were the Impact and Consequences?

Cybersecurity Content Specialist

Amazon’s Sudden Retreat

On July 23, 2025, Amazon abruptly withdrew all of its ads from Google Shopping. Amazon had long been one of Google’s biggest advertisers, often dominating Shopping results and pushing CPCs higher for everyone else.

For advertisers, this initially looked like good news. With less competition from Amazon, auction pressure eased. Optmyzr’s analysis showed that average CPC decreased by 8.3% in the week following Amazon’s exit (excluding Prime Day effects). At the same time, impressions rose by 5% and clicks increased by 7.8%, suggesting advertisers could buy more traffic at lower cost. On the surface, that’s a win.

Why Lower CPCs Didn’t Boost ROI

The catch? Lower CPCs didn’t translate into better outcomes. Optmyzr found that conversion value dropped by 5.5%, conversion rate declined by 7.2%, and overall ROAS fell by 4.4%. In other words, advertisers were paying less for clicks but also getting less value from them.

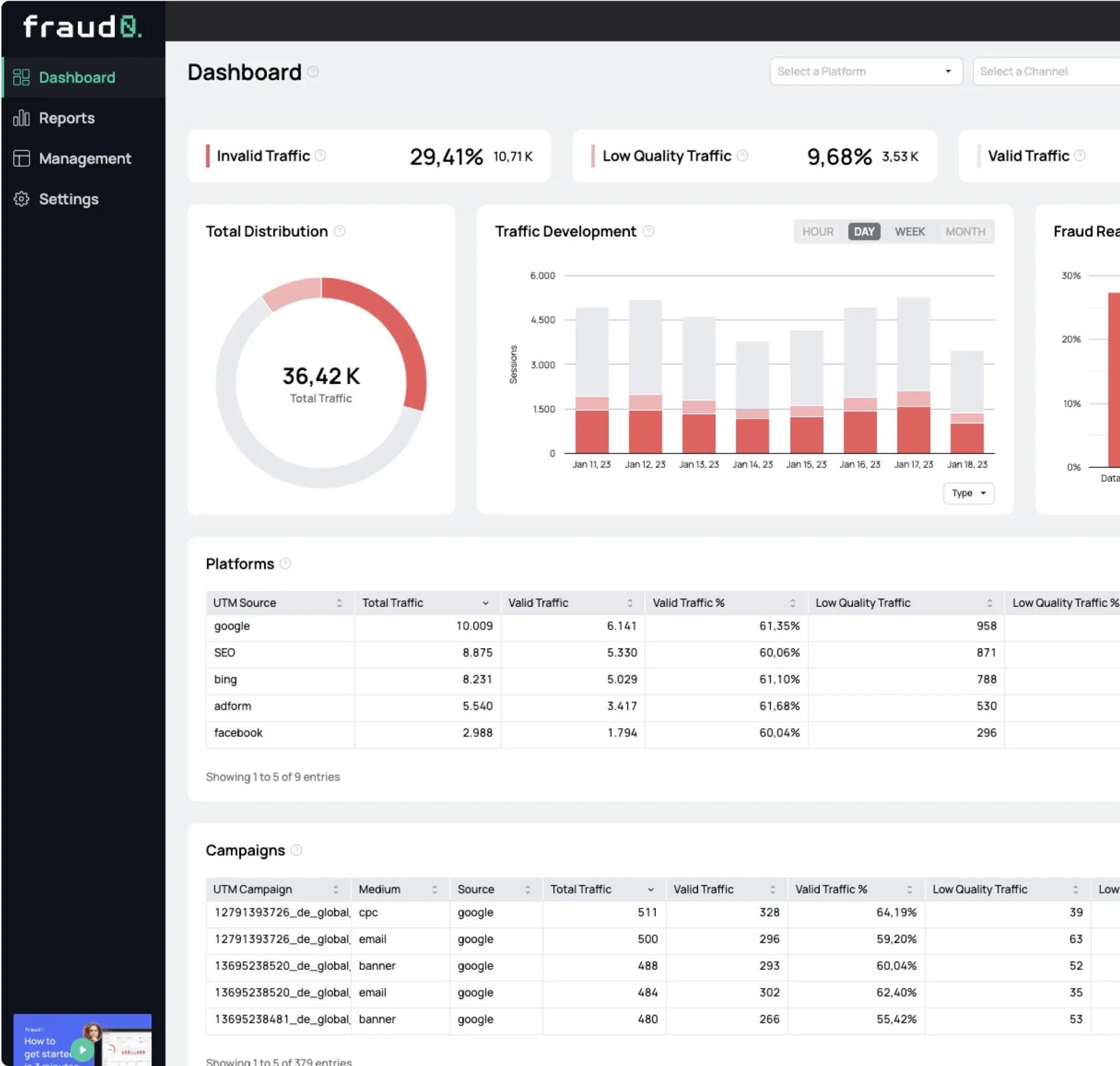

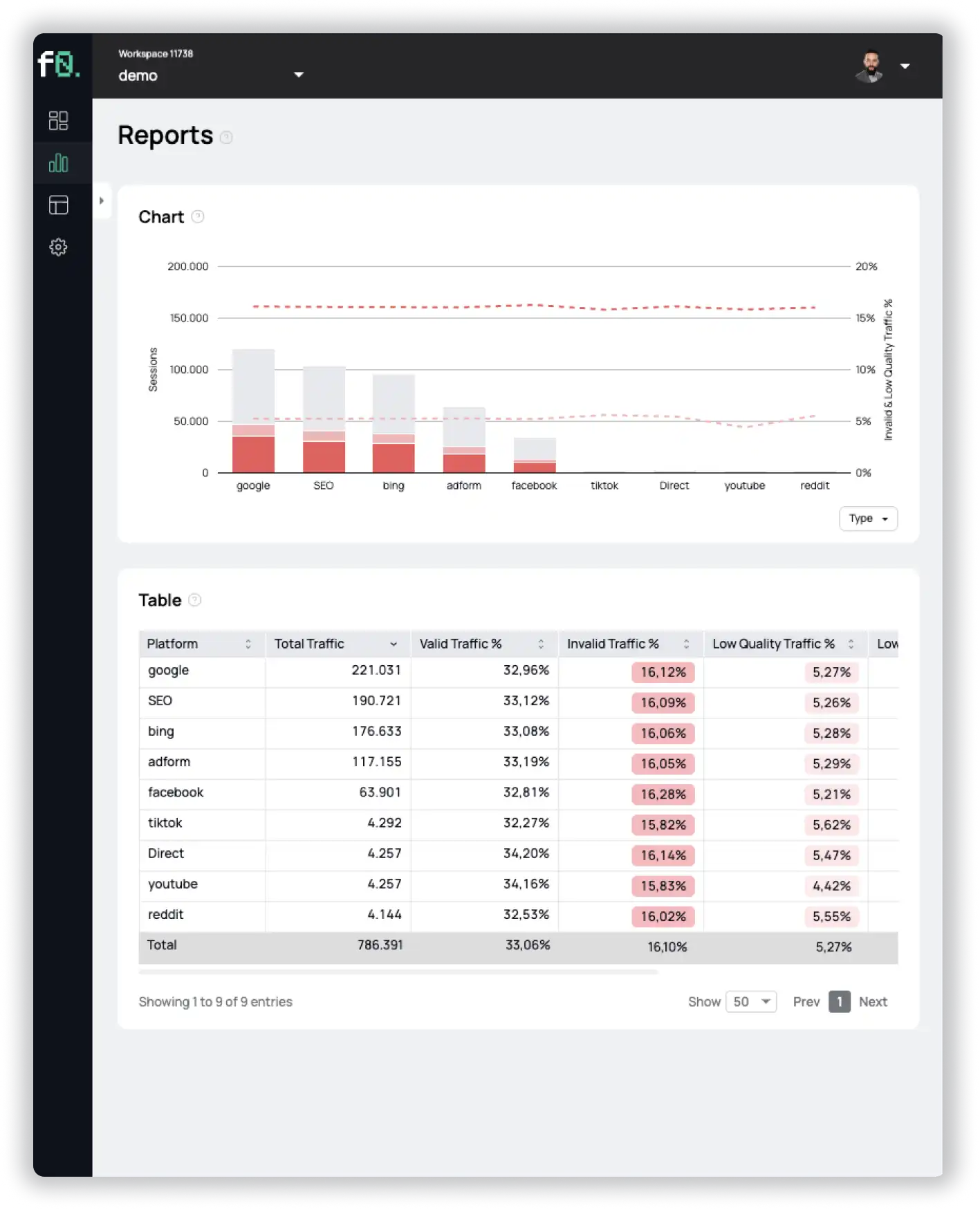

This is where fraud0’s perspective becomes critical. Our Unmasking the Shadows 2025 report shows that 21.3% of all onsite traffic is invalid, and nearly 10% of conversions are generated by bots. So even when clicks get cheaper, a significant portion of them may still be worthless because they never come from real users in the first place.

The Hidden Risk in Search and Shopping

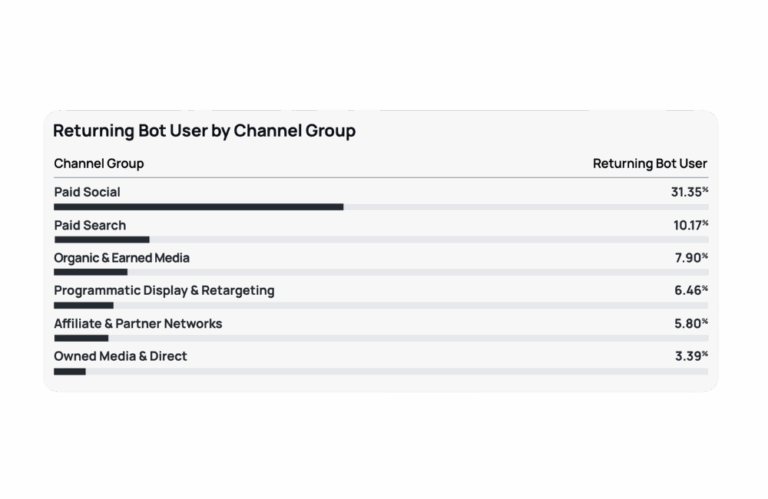

Amazon’s departure shifted attention back to Google Shopping, but these campaigns face a persistent quality problem. fraud0 data shows that paid search carries 7% invalid traffic. Bots also return repeatedly: 5.2% of bot users reappeared within the same quarter, generating almost 18% of all bot sessions. That means remarketing lists and optimization algorithms often get trained on fake activity, not real customer behavior.

So while CPCs dropped after Amazon’s exit, the “effective cost per real user” may not have improved at all. If fake traffic still makes up a large share, then advertisers risk mistaking cheaper clicks for genuine efficiency gains.

Consequences Beyond the Auction

The broader consequence of Amazon leaving Google Ads is that it exposed how fragile performance metrics can be. Many advertisers saw the lower CPCs and higher click volumes as success, but ignored the fact that conversions and ROAS actually fell. Combined with the ongoing threat of invalid traffic, this paints a more sobering picture: advertisers may be spending more to chase cheaper clicks that ultimately don’t convert.

What Advertisers Should Do

The lesson from both Optmyzr’s analysis and fraud0’s research is clear: don’t measure success by CPC alone. Market shifts like Amazon’s exit change the surface-level economics of auctions, but the underlying problem of traffic quality remains.

Advertisers need to measure traffic onsite to see how much is human, validate conversions to filter out bot-driven “sales,” and use real-time detection to block invalid traffic before it wastes spend. Only then can they be sure that lower CPCs lead to real gains.

Conclusion

Amazon’s abrupt retreat from Google Ads in July 2025 reshaped the auction landscape. CPCs fell by 8.3%, impressions rose 5%, and clicks increased 7.8%. But at the same time, conversion value dropped 5.5%, conversion rates fell 7.2%, and ROAS declined 4.4%.

The takeaway is clear: Amazon’s exit lowered costs, but it didn’t eliminate inefficiencies. As fraud0’s data shows, more than one in five visits online is still invalid, and bots continue to pollute campaigns. The real winners in this new landscape won’t be those who simply enjoy cheaper clicks, but those who ask: are these clicks real?

See what’s hidden: from the quality of website traffic to the reality of ad placements. Insights drawn from billions of data points across our customer base in 2024.

- Published: September 3, 2025

- Updated: September 3, 2025

1%, 4%, 36%?