- Blog

$25M Accounting Fraud Shows How Programmatic Complexity Fuels Trust Problems

Cybersecurity Content Specialist

The Fraud Case: Round-Trip Scheme Unveiled

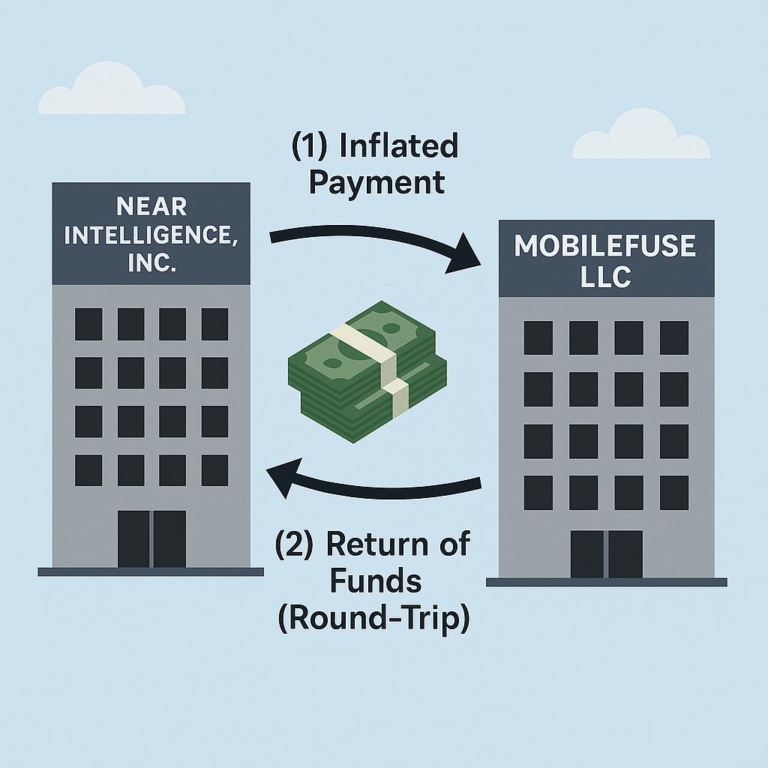

In early August 2025, federal prosecutors in Manhattan charged three executives from Near Intelligence, Inc. and MobileFuse LLC in connection with a $25 million accounting fraud. The scheme, which ran from 2021 through 2023, involved so-called “round-trip” transactions: Near made inflated payments to MobileFuse, which then sent the money back. On paper, Near’s books showed revenue growth. In reality, the cash was just going in circles.

This false picture made the company appear far healthier than it was, helping it look more attractive to investors and potential buyers. Prosecutors say more than $25 million was recycled through the system, with some funds even diverted for personal use. Near’s CEO Anil Mathews and CFO Rahul Agarwal now face charges of conspiracy, securities fraud, and wire fraud, while Kenneth Harlan, CEO of MobileFuse, was also arrested. Mathews is fighting extradition from France, and Agarwal remains at large.

Why This Still Hits Programmatic Advertising

At first glance, this is a corporate accounting fraud case, not a traditional “ad fraud” story involving bots or fake clicks. But the way the scheme was hidden makes it highly relevant to the ad tech world. The fraudsters didn’t invent fake products — they used the complexity of programmatic ad transactions as cover.

Programmatic advertising is already notorious for its lack of transparency. Money flows through a chain of exchanges, intermediaries, and verification systems that few outsiders truly understand. In this case, that very opacity became the perfect smokescreen for a massive financial deception.

The Bigger Trust Problem

The indictment shows once again how fragile trust in programmatic systems really is. If ad transaction data can be bent to mislead investors, it raises serious questions for marketers, too. How confident can anyone be that the numbers they see — whether it’s impressions, installs, or revenue tied to campaigns — truly reflect reality?

When advertising infrastructure can double as a tool for accounting tricks, it undermines confidence across the board. Transparency isn’t just a “nice to have” for marketers — it’s essential for the integrity of the entire digital ecosystem.

Final Take

The Near–MobileFuse case wasn’t ad fraud in the classic sense. But by exploiting the murky world of programmatic ad flows, it revealed just how easily opacity can be weaponized. Until accountability and clarity are built into the system, trust in programmatic will remain on shaky ground.

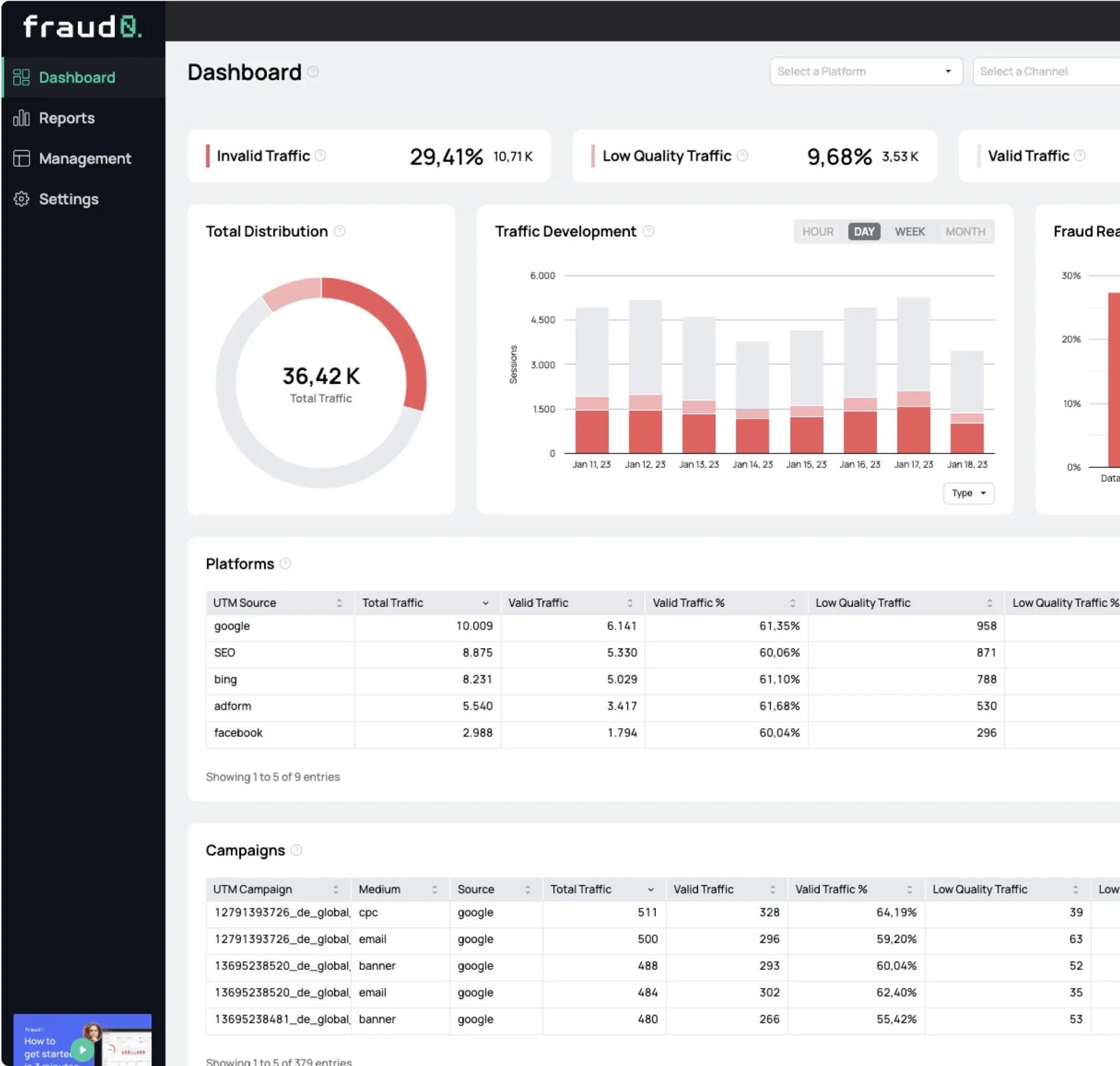

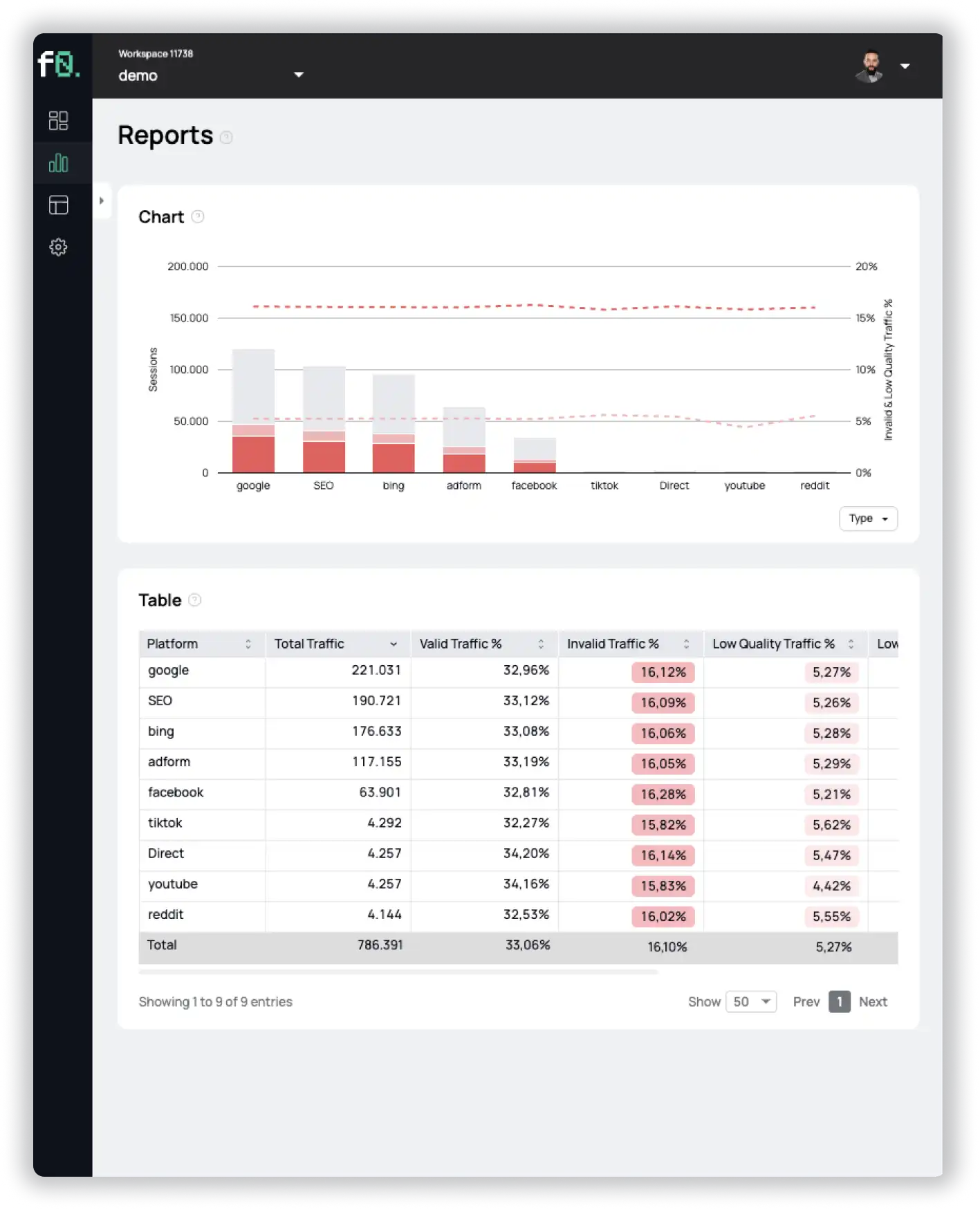

See what’s hidden: from the quality of website traffic to the reality of ad placements. Insights drawn from billions of data points across our customer base in 2024.

- Published: September 8, 2025

- Updated: September 8, 2025

1%, 4%, 36%?